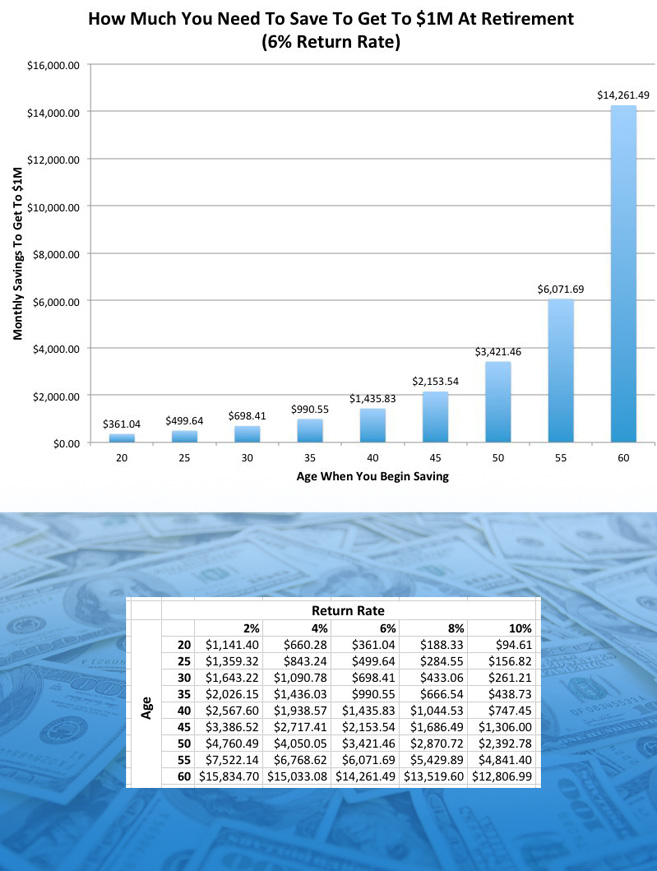

The thought of retiring with a million dollars in the bank might seem like a pipe dream to most people, but financial experts at Business Insider have shown us it’s not that far out of reach. When they crunched the numbers, they discovered what it would take for people in each age group from 20 to 60 to come out with $1 million in the bank at a retirement age of 65, and with a compound interest of 6%. If you’re smart you’ll start young — 20-year-olds who can put away $361 each month can make it to $1 million in 45 years. If you’re starting at 35 you’ll need to put away $990. And if you’re starting at 60, you’ll need to set aside a whopping $14,261 every 30 days for the next 5 years. The real take-home lesson here is to start young. A 20-year-old whose first monthly payment of $361 will see that instalment balloon to an impressive $5,336 in 45 years. Or you could forget all this nonsense and get your ass onto Wheel Of Fortune like the woman below.

SEE ALSO: Retired Couple Explains Why They Sold Their House To Become “Senior Gypsies” & Travel The World

SEE ALSO: Millennials And Money: Suze Orman’s Top Three Nuggets Of Financial Advice For Those Of Us In Our 30s

.