Jesus himself would be furious at the state of the Catholic Church in 2012. If he was alive today he would be the first one to lead the growing protests against a religious institution that has completely misunderstood his message: heaven is not a patch of real estate in the sky that we are given access to by obeying a list of draconian dogma — heaven is enlightenment. And if the Catholic Church fails to understand this, it will quickly fade away into irrelevancy.

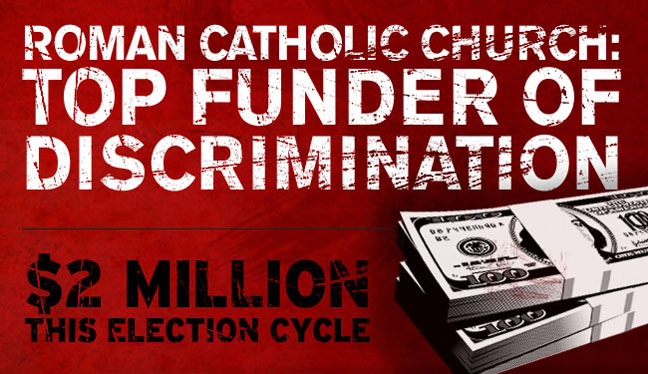

Case in point is the fact that according to Public Religion Research Institute 60% of American Catholics support marriage equality, yet the Human Rights Council caught U.S. Church’s leaders red-handed this election cycle as the #1 supporters of discrimination. HRC discovered that the Catholic Church donated $2 million to the conservative efforts to block marriage equality in Minnesota, Maryland, Maine and Washington State. And this is just the beginning, folks. There are even more disgusting details emerging of the Catholic Church’s nefarious — and highly illegal — discriminatory meddling in political affairs, and you can read it in full by visiting HRC.org.

Now, a First Amendment watchdog group is suing the Internal Revenue Service for failing to challenge the tax-exempt status of the Catholic Church and other religious organizations whose pastors engage in partisan politicking from the pulpit. The Washington Post writes:

The Freedom From Religion Foundation, which advocates total separation of church and state, filed the lawsuit Wednesday (Nov. 14) in U.S. District Court in Western Wisconsin, where the 19,000-member organization is based. The lawsuit claims that as many as 1,500 pastors engaged in “Pulpit Freedom Sunday” on Sunday, Oct. 7, when pastors endorsed one or more candidates, which is a violation of IRS rules for non-profit organizations. IRS rules state that organizations classified as 501 (c) (3) non-profits — a tax-exempt status most churches and other religious institutions claim — cannot participate or intervene in “any political campaign on behalf of (or in opposition to) any political candidate.” Though the regulation has been in place since 1954, a federal court ruled in 2009 that the IRS no longer had the appropriate staff to investigate places of worship after a reorganization changed who in the agency had the authority to launch investigations. IRS rules do allow for some nonpartisan activity by religious institutions, including organizing members to vote and speaking out on issues. But endorsing or supporting specific candidates could jeopardize their tax-exempt status. But a recent Associated Press story reported that the IRS has not challenged any religious organizations on charges of electioneering in the past three years. An IRS spokesperson told the AP that it was “holding any potential church audits in abeyance” until rules on electioneering could be “finalized.” The lawsuit also challenges the legality of several full-page newspaper advertisements paid for by the Billy Graham Evangelistic Association, another 501 (c) (3), that exhorted voters to vote along “biblical principles.”

You can read more about the FFRF’s suing the IRS for not revoking the tax-emption status of these religious institutions by visiting WashingtonPost.com. And to read one of my favorite FEELguide stories where the Archbishop of Milan blasted the Vatican as being 200 years out of date be sure to click here: FEELguide Hero: Cardinal Carlo Maria Martini Trashes Catholic Church As “200 Years Out Of Date”